Производители рулонов из нержавеющей стали 304

Are you struggling to find a reliable stainless steel 304 coil manufacturer amid market volatility? Inconsistent quality and unpredictable lead times can disrupt your operations and inflate costs. Partnering with the right manufacturer is crucial to building a resilient supply chain and protecting your bottom line.

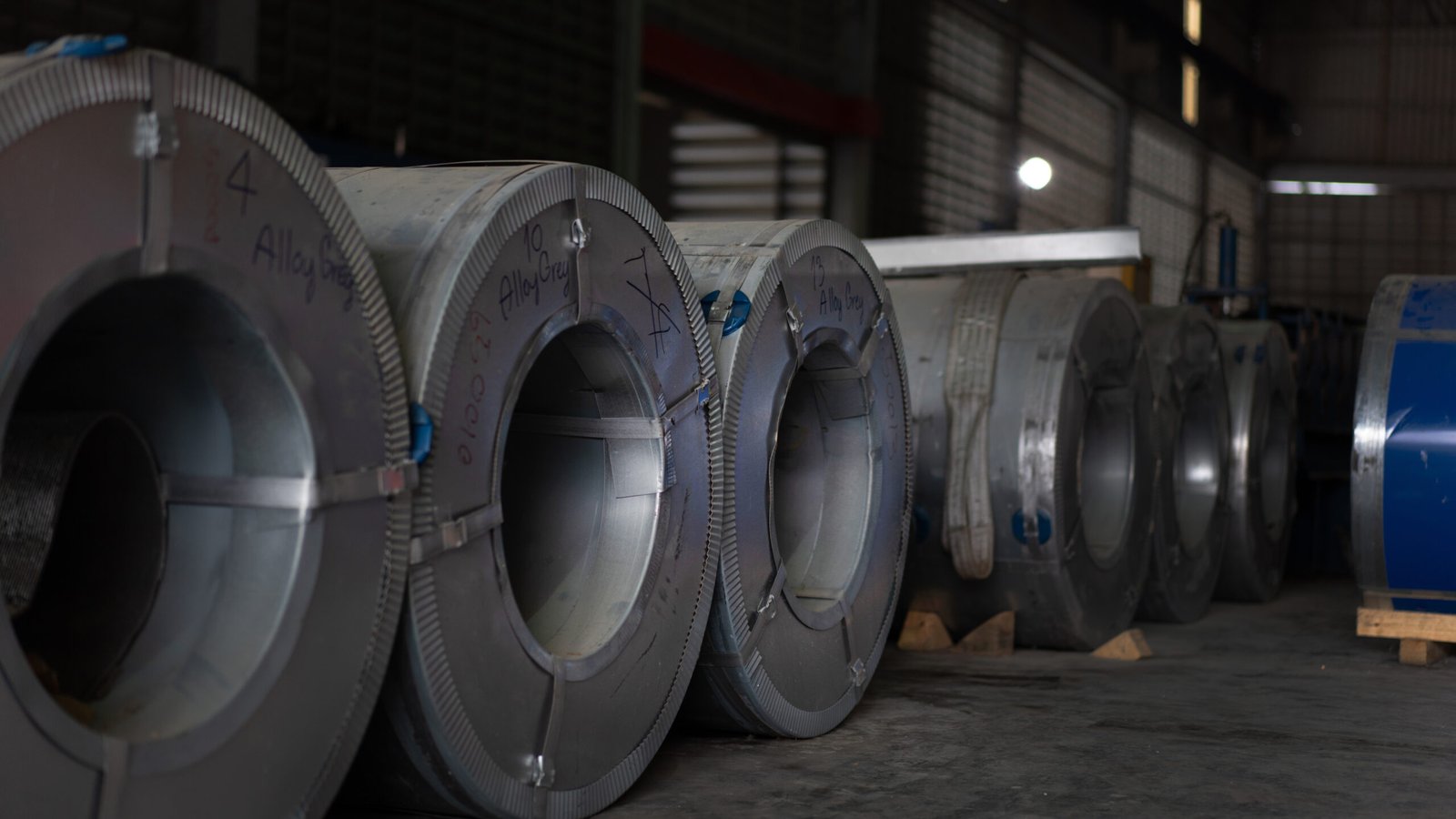

Stainless steel 304 coil manufacturing is a dynamic global industry driven by industrial demand and raw material costs. Manufacturers range from massive, integrated mills to specialized regional producers. Key selection criteria for buyers include quality assurance protocols, production capacity, technological sophistication, and overall supply chain reliability.

Choosing a supplier is one of the most critical decisions you'll make. The difference between a transactional vendor and a strategic manufacturing partner can translate into millions in revenue, improved efficiency, and a stronger competitive position. But how do you navigate this complex landscape? This guide will break down the essential factors, from the industry's historical roots1 to the latest technological trends, empowering you with the knowledge to select a partner that truly fuels your growth.

The decision is no longer just about securing the lowest price per ton. It's a strategic calculation of risk versus reward. While global sourcing, particularly from hubs like China, offers clear cost advantages, recent trade policies and logistical shocks have underscored the paramount importance of supply chain resilience. A McKinsey report noted that significant supply chain disruptions can erase nearly 40% of a year's profits over a decade. At MFY, we've guided clients through this evolving reality, helping them build robust supply networks that can withstand both economic and geopolitical turbulence. It's about forging a partnership built for long-term stability and success.

What is the background of stainless steel 304 coils manufacturing?

Ever wondered how the ubiquitous 304 stainless steel coil came to dominate countless industries? Its history might seem like a distant academic point. However, ignoring its evolution means you might miss the crucial context behind quality standards, pricing fluctuations, and regional manufacturing strengths, leaving you vulnerable.

The manufacturing of stainless steel 304 coils traces its origins to the early 20th century, following the discovery of chromium's corrosion-resistant properties. Its development was accelerated by post-war industrial demand for a durable, formable, and cost-effective material, cementing its essential role across modern industries.

Understanding this historical arc is far from an academic exercise; it provides the essential context for navigating today's market. The initial development in Europe and North America established the foundational quality benchmarks like ASTM and EN that we still rely on globally. The subsequent migration of mass production to Asia—first Japan, then South Korea, and ultimately China—in the latter half of the 20th century fundamentally reshaped global cost structures and supply dynamics. As the Global Business Director at MFY, I’ve personally seen how this legacy influences client expectations. A partner in Germany, for example, may have deeply ingrained quality verification protocols that differ from those of a fast-growing contractor in Southeast Asia, both shaped by their unique industrial histories. Recognizing this background allows us to bridge communication gaps and tailor our production and service models effectively. It explains why certain regions excel in specific finishes or thicknesses and why price points can vary so dramatically. This knowledge elevates you from a mere buyer to a strategic sourcing expert, equipped to navigate the global marketplace with confidence.

The journey of the 304 coil is a story of scientific discovery, industrial necessity, and globalization. It began with a simple observation and evolved into one of the most critical materials of the modern age. By tracing its key developmental phases, we can better appreciate the forces that continue to shape its production and application today. From the laboratory to the factory floor, each step in its history has contributed to the quality, availability, and versatility we often take for granted. This deep dive will illuminate the milestones that made Grade 304 stainless steel the industrial workhorse it has become.

The Genesis: Early 20th-Century Innovation

The story of stainless steel begins in 1913 with the work of Harry Brearley in Sheffield, England. While researching improved steel alloys for firearm barrels, he discovered that a steel formulation with around 13% chromium exhibited remarkable resistance to corrosion from acids like lemon juice and vinegar. This discovery, though initially accidental, laid the groundwork for an entirely new class of materials. This "rustless steel" was initially applied to cutlery, where its hygienic and durable properties were an immediate success.

The true breakthrough for industrial applications came with the development of austenitic stainless steels, specifically the "18-8" alloy—containing approximately 18% chromium and 8% nickel. This composition, which is the foundation of modern Grade 304, offered a superior combination of corrosion resistance, weldability, and formability compared to early chromium-only steels. Pioneers in Germany and the UK refined these alloys, but the manufacturing process was initially laborious and expensive, limiting its use to high-value applications. The metallurgical challenges of melting, casting, and rolling these new alloys meant production was confined to small, specialized batches, with costs running several times higher than conventional carbon steel.

Overcoming these early production hurdles was key to unlocking the material's potential. Metallurgists and engineers worked to control the precise chemistry and developed new refining techniques to improve purity and consistency. As these methods matured, the feasibility of producing larger quantities improved, setting the stage for stainless steel to move from a niche specialty material to an industrial staple. This early period was defined by innovation and problem-solving, creating the foundation for the mass production that would follow.

The Post-War Boom and Standardization

The period following World War II was a catalyst for the widespread adoption of 304 stainless steel. The global effort toward reconstruction and the rapid expansion of the chemical, food processing, and energy industries created unprecedented demand for a material that was both durable and non-reactive. Grade 304, with its excellent performance and declining production cost, was perfectly positioned to meet this need. It became the material of choice for everything from chemical storage tanks and dairy equipment to architectural panels and kitchen sinks.

This industrial boom necessitated standardization to ensure reliability and interoperability. Organizations like the American Society for Testing and Materials (ASTM) developed comprehensive standards, such as ASTM A240, which specifies the chemical composition, mechanical properties, and tolerances for stainless steel plate, sheet, and strip. These standards were revolutionary. I recall working with an engineering contractor on a project to refurbish a 1960s-era food processing plant. The original specifications all cited ASTM A240, which allowed us to seamlessly supply modern 304 coils that met the exact performance requirements, ensuring the plant's safety and longevity without costly reverse engineering. Standardization transformed 304 from a proprietary alloy into a reliable, globally recognized engineering commodity.

The concurrent development of new manufacturing technologies was equally transformative. The introduction of the Argon Oxygen Decarburization (AOD) process in the 1960s allowed for more efficient removal of carbon during refining, improving quality and lowering costs. Furthermore, the advent of continuous casting and wide-strip hot rolling mills revolutionized the scale of production. These innovations made it possible to produce vast quantities of high-quality stainless steel coils efficiently, making Grade 304 affordable and accessible for an ever-expanding range of applications, from humble household appliances to critical automotive components.

The Shift to Asia and Modern Mass Production

The late 20th century marked a fundamental geographic shift in stainless steel production. Initially led by Japan and South Korea, the center of gravity for mass production began moving decisively to Asia. This trend was driven by a combination of factors, including government industrial policies, lower labor costs, and rapidly growing domestic demand for infrastructure and consumer goods. These Asian producers invested heavily in modern production technology, quickly closing the quality gap with established Western mills.

China's accession to the World Trade Organization (WTO) in 2001 was the pivotal moment that unleashed its full manufacturing potential. The country's stainless steel output skyrocketed, growing from less than 2 million metric tons in 2001 to over 30 million tons two decades later, now accounting for more than half of all global production. This explosion in capacity created a hyper-competitive global market, driving down prices and making stainless steel more accessible than ever. For global buyers, this shift presented both immense opportunity and new challenges in navigating a more complex supply chain.

This expansion was not merely about quantity. Leading Chinese manufacturers like MFY made substantial investments in cutting-edge technology, from ultra-efficient refining furnaces to sophisticated 20-high cold-rolling mills capable of producing mirror finishes with precise gauge control. As a result, the quality and consistency of Chinese-made 304 coils now meet and often exceed the most stringent international standards. This globalization of high-quality, high-volume production is the defining feature of the market we operate in today, offering a dynamic and competitive landscape for buyers worldwide.

| Era | Key Development | Impact on Manufacturing |

|---|---|---|

| 1910s - 1930s | Discovery & development of "18-8" alloy (Grade 304) | Small-batch, high-cost, specialized, and experimental production |

| 1940s - 1970s | Post-war industrial boom & standardization (ASTM/EN) | Mass production begins, quality becomes standardized and reliable |

| 1980s - Present | Shift of production to Asia (Japan, S. Korea, China) | Globalization, massive capacity increase, intense cost competition |

Нержавеющая сталь 304 содержит хромПравда

Grade 304 stainless steel contains approximately 18% chromium, which gives it corrosion-resistant properties.

304 was developed in the 19th centuryЛожь

The foundational work on 304 stainless steel began in 1913, making it a 20th century innovation.

How is the current market situation for stainless steel 304 coil manufacturers?

The global market for 304 coils often feels volatile and opaque, with nickel price swings and trade disputes creating constant uncertainty. This instability makes budgeting difficult and supply chains appear fragile, where one wrong purchasing decision can quickly erode your profit margins and delay critical projects.

The current market for stainless steel 304 coil manufacturers is defined by intense global competition, significant price volatility tied to raw materials like nickel prices, and dynamically shifting supply chains. China continues to be the dominant producer, while manufacturing hubs in India and Southeast Asia are gaining prominence.

Navigating this market successfully requires more than a cursory glance at the London Metal Exchange (LME) nickel prices. It demands a nuanced understanding of an intricate web of interconnected factors. From geopolitical tensions influencing trade tariffs to the growing importance of sustainability as a purchasing criterion, the landscape is more complex than ever. I speak with clients daily who are grappling with these very issues. For instance, a major distributor we partner with in the Middle East recently faced a tough decision: accept a rock-bottom price from a new, unproven supplier or stick with a trusted partner like MFY at a slightly higher cost. Their decision hinged not on the invoice value alone, but on a strategic assessment of risk—the risk of a shipment delay derailing a customer's production line, or the risk of quality variance leading to costly rejections. These are the real-world consequences of the current market situation. This section will dissect the dominant production regions, key demand drivers, and pricing mechanisms to provide you with the clarity needed for strategic sourcing.

The global stage for stainless steel 304 coil manufacturing is a dynamic arena where regional strengths, market demands, and economic pressures collide. Understanding this ecosystem is fundamental to making informed procurement decisions that balance cost, quality, and risk. It's a landscape shaped by a few dominant players but also influenced by emerging contenders who are changing the competitive dynamics. For any business relying on a steady supply of 304 coils, a clear view of this situation is not just beneficial—it's essential for strategic planning and maintaining a competitive edge.

Dominant Production Hubs and Competitive Landscape

China stands as the undisputed leader in the stainless steel market, producing over 55% of the world's total output2. This dominance isn't accidental; it's the result of decades of strategic investment in an integrated supply chain, from raw material processing to advanced finishing. This immense scale allows producers like MFY to achieve significant economies of scale, leveraging a robust domestic logistics network and vast production capacity to offer globally competitive pricing and lead times. This ecosystem provides a one-stop-shop advantage that is difficult for other regions to replicate.

However, the landscape is not monolithic. India has emerged as a major growth story in the stainless steel sector. Companies like JSL and SAIL are aggressively expanding their capacity to cater to a booming domestic market and to increase their export footprint, particularly to Europe and the Middle East. Simultaneously, Southeast Asia, especially Indonesia and Vietnam, is becoming a significant player. Often fueled by Chinese investment in nickel-rich regions like Indonesia, these countries offer a compelling combination of raw material access and low production costs, though sometimes with challenges in logistical infrastructure and quality consistency. Meanwhile, traditional producers in Europe and North America have largely shifted their focus away from commodity 304 coils towards higher-margin, specialized alloys and niche applications.

The competitive dynamic today extends far beyond price. While cost is always a factor, sophisticated buyers now weigh lead times, quality consistency, logistical prowess, and after-sales service just as heavily. I recently worked with a manufacturing client in India who had historically sourced from a European mill. They faced extended lead times and high logistical costs. By partnering with MFY, they not only achieved a more favorable price point but, more importantly, leveraged our integrated logistics hub in China to cut their door-to-door delivery time by nearly 40%. This enhancement in supply chain agility directly translated into a stronger competitive advantage for their business.

Key Demand Drivers and End-Use Sectors

The construction and infrastructure sector remains the single largest consumer of stainless steel 304 coils globally. Rapid urbanization, particularly in developing nations across Asia and Africa, fuels relentless demand for durable and low-maintenance building materials. Grade 304 is extensively used for architectural facades, roofing, structural components, and piping systems, where its combination of strength, corrosion resistance, and aesthetic appeal provides long-term value.

The automotive industry is another critical pillar of demand. Stainless steel 304 is the material of choice for exhaust systems, trim, and various structural components due to its ability to withstand high temperatures and corrosive environments. Contrary to some predictions, the global shift towards electric vehicles (EVs) has not diminished this demand. In fact, new applications are emerging for stainless steel in EV battery enclosures and cooling systems, where its durability and thermal management properties are highly valued. The average modern vehicle contains between 15 and 20 kilograms of stainless steel, a figure that is expected to remain stable or even grow.

A diverse range of other sectors provides a stable demand base, insulating the market from downturns in any single industry. Consumer goods, including kitchenware and major appliances like refrigerators and washing machines, rely on 304 for its hygienic properties and premium finish. The food and beverage processing and medical equipment industries are also heavy users, where the material's non-reactive and easily sanitized surface is a non-negotiable requirement. This broad application spectrum ensures that demand for 304 coils remains robust and multifaceted.

Pricing Volatility and Supply Chain Pressures

The single greatest factor influencing 304 coil pricing is the fluctuating cost of nickel on the LME. As a key alloying element, nickel can account for a significant portion of the material's total cost. As a rule of thumb, a 10% change in the nickel price can impact the final cost of a 304 coil by as much as 3-5%. This inherent volatility poses a constant challenge for both manufacturers and buyers trying to forecast costs and manage budgets. At MFY, we employ sophisticated hedging strategies and offer long-term pricing agreements to help our clients mitigate this risk, but it remains an ever-present market force.

Geopolitics and trade policies add another layer of complexity and uncertainty. Anti-dumping duties, countervailing tariffs, and economic sanctions can redraw global trade routes almost overnight. For example, tariffs imposed by the United States and the European Union on certain Chinese stainless steel products have diverted some trade flows towards Southeast Asia and India. It is imperative for global buyers to stay informed of these evolving regulations, as they can have a direct and substantial impact on landed costs and supplier viability.

Finally, logistical challenges have become a major source of pressure on the supply chain. The disruptions witnessed during the COVID-19 pandemic, coupled with recent events like the crisis in the Red Sea, have starkly illustrated the fragility of global shipping networks. Container shortages, port congestion, and soaring freight rates add significant cost and uncertainty. This pressure forces buyers into a crucial strategic dilemma: do you rely on a single, low-cost region and accept the inherent risks, or do you diversify your supplier base across multiple geographies to build resilience? Our model at MFY is designed to address this by acting as a highly resilient and reliable partner within a key global hub, proactively managing logistics to insulate our clients from as much of this volatility as possible.

| Region | Key Strengths | Key Challenges | Primary Target Markets |

|---|---|---|---|

| China | Unmatched scale, integrated supply chain, cost | Subject to trade tariffs, geopolitical scrutiny | Global, especially Asia & Middle East |

| India | Strong domestic growth, improving quality | Infrastructure bottlenecks, some raw material import | Domestic, Middle East, Europe |

| Europe/NA | Leader in high-spec/specialty grades, R&D | High production costs, less focus on commodity 304 | High-value domestic industrial markets |

| SE Asia | Low cost, rich in raw materials (Nickel) | Developing infrastructure, quality consistency | Regional (ASEAN), China, other exports |

Nickel prices impact 304 coil costsПравда

A 10% change in nickel prices can affect 304 coil costs by 3-5%, making it a key pricing factor.

EVs reduce stainless steel demandЛожь

EVs actually create new applications for stainless steel in battery enclosures and cooling systems.

What are the common challenges faced by manufacturers of stainless steel 304 coils?

As a manufacturer, it’s easy to think our challenges are invisible to our customers. You see the final coil, but not the complex balancing act required to produce it. These internal pressures, from cost control to regulatory compliance, directly impact the product you receive and the stability of your supply chain.

Manufacturers of stainless steel 304 coils commonly face challenges including managing volatile raw material costs, maintaining stringent quality control across large production volumes, navigating complex environmental regulations, and addressing a shortage of skilled labor in specialized metallurgical and operational roles.

These are not abstract business school problems; they are daily operational realities. Fluctuating nickel and chromium prices3 can compress margins unexpectedly, forcing difficult decisions about inventory and pricing. Ensuring every coil that leaves our facility meets precise specifications requires constant investment in technology and rigorous process control, because a single quality lapse can have significant repercussions for our clients' production lines. Furthermore, the push for greener manufacturing means we are continually innovating to reduce our energy consumption and environmental footprint, a necessary but capital-intensive endeavor. At MFY, we believe that transparency about these challenges is key to building trust. When you understand the pressures we manage, you can better appreciate the value of a partner who consistently overcomes them to deliver a reliable product. Let’s explore these hurdles in more detail.

Behind every perfect coil of stainless steel lies a series of formidable challenges that manufacturers must master. These hurdles are not unique to one company or region but are intrinsic to the nature of modern, large-scale metals production. From the volatility of global commodity markets to the microscopic details of metallurgical quality, success depends on a manufacturer's ability to navigate a complex and demanding operational environment. Understanding these challenges provides crucial insight into what separates an average supplier from a world-class manufacturing partner.

Managing Raw Material and Energy Cost Volatility

The most persistent challenge for any 304 coil manufacturer is managing the extreme volatility of raw material prices, particularly nickel, which is traded on global commodity exchanges. Nickel prices can swing dramatically based on factors that have nothing to do with steel demand, such as mining disruptions, geopolitical events, or speculative trading. Since nickel is a primary cost component, these fluctuations directly impact the cost of production and can make long-term planning incredibly difficult. A manufacturer must be adept at sophisticated procurement strategies, including hedging, long-term contracts with miners, and strategic inventory management, to buffer both the business and its customers from this price instability.

Energy costs represent another significant and volatile operational expense. Steelmaking is an energy-intensive process, requiring vast amounts of electricity and natural gas to power electric arc furnaces (EAFs), AOD converters, and reheating furnaces. In many regions, energy prices are subject to market fluctuations and government policy changes, adding another layer of cost uncertainty. I've seen firsthand how a sudden spike in regional electricity tariffs can impact production costs overnight. To counter this, leading manufacturers like MFY invest heavily in energy-efficient technologies, such as regenerative burners and waste heat recovery systems, and optimize production schedules to align with off-peak energy rates. According to the World Steel Association, energy can account for 20-40% of a steel plant's total operational costs, making efficiency a critical competitive battleground.

This constant financial pressure requires a disciplined and proactive approach. It's a continuous balancing act between securing raw materials at favorable prices without over-extending on inventory, and investing in energy efficiency without compromising production capacity. Manufacturers who master this balance are better positioned to offer stable pricing and reliable supply, providing a significant advantage to their customers.

Ensuring Stringent Quality and Consistency

For our customers in demanding sectors like automotive, medical, and food processing, quality is not negotiable. The challenge for a manufacturer is maintaining absolute consistency across millions of tons of production. A minor deviation in chemical composition, gauge tolerance, or surface finish can render an entire coil useless for a specific application, leading to costly rejections and production downtime for the client. The goal is to achieve a Six Sigma level of quality, where defects are virtually nonexistent.

This requires a multi-layered approach to quality control that begins before the raw materials even enter the furnace. We rigorously test incoming scrap metal and ferroalloys to ensure their purity. During the melting and refining process, automated sensors and spectroscopic analysis provide real-time feedback on the steel's chemistry, allowing for precise adjustments. For example, our AOD converters are equipped with advanced process control systems that ensure the carbon and sulfur content is reduced to exact specifications, which is critical for the corrosion resistance and weldability of 304 stainless steel. A client in the construction industry, for example, relies on our certified material test reports (MTRs) to guarantee that the structural components they fabricate will meet local building codes for tensile strength and ductility.

The quality assurance process continues through the hot and cold rolling stages. Sophisticated automated gauge controls (AGCs) and shape-meters continuously monitor and adjust the rollers to maintain uniform thickness and flatness down to the micron level. Surface inspection is equally critical. High-resolution cameras and machine vision systems scan 100% of the coil surface for imperfections like scratches, pits, or roll marks that would be unacceptable in consumer-facing applications. This relentless focus on process control and inspection, backed by a robust quality management system like ISO 9001, is the only way to deliver the flawless, consistent product our customers demand.

Navigating Environmental Regulations and Sustainability Demands

The steel industry has historically been a significant source of CO2 emissions and other pollutants, and manufacturers today face mounting pressure from regulators and customers to operate more sustainably. Navigating this complex and ever-changing landscape of environmental regulations is a major challenge. Compliance requires substantial investment in pollution control technologies, such as advanced baghouse systems to capture particulate matter and sophisticated water treatment facilities to handle process water. These are not one-time investments; they require continuous upkeep and upgrades as standards become more stringent.

The focus is increasingly shifting from pollution control to decarbonization. The global push towards "green steel" presents both a challenge and an opportunity. The primary route for stainless steel production, the Electric Arc Furnace (EAF), is already more environmentally friendly than traditional blast furnaces as it primarily uses recycled scrap metal. However, the process is still electricity-intensive. The challenge lies in sourcing that electricity from renewable sources and further improving energy efficiency. A recent report by the IEA highlights that the steel industry is responsible for about 7% of global energy sector emissions, putting intense pressure on producers to innovate.

At MFY, we view sustainability not just as a compliance issue but as a core part of our competitive strategy. We actively work with our clients to document the recycled content of our products, which can contribute to their own sustainability goals and certifications like LEED for green buildings. We are continuously investing in process innovations that reduce our energy consumption per ton of steel produced. For example, a recent furnace upgrade at one of our facilities reduced electricity consumption by 15%, a move that was good for the environment and our bottom line. Meeting these sustainability demands is essential for maintaining our social license to operate and for partnering with a new generation of environmentally-conscious global companies.

| Challenge | Primary Impact on Manufacturer | Consequence for the Customer |

|---|---|---|

| Raw Material & Energy Volatility | Unpredictable production costs, margin compression | Price fluctuations, potential for supply instability |

| Stringent Quality Control | High investment in technology and process management | Risk of receiving defective material, production downtime |

| Environmental Regulations | Increased capital expenditure and operational costs | Can affect supplier cost structure and long-term viability |

| Skilled Labor Shortage | Difficulty in operating/maintaining complex equipment | Potential for quality inconsistencies, production delays |

Nickel price volatility affects 304 coil costsПравда

Nickel is a key component of 304 stainless steel, and its global commodity price swings directly impact production costs.

EAFs produce more emissions than blast furnacesЛожь

Electric Arc Furnaces (EAFs) used for stainless steel are cleaner, primarily using recycled scrap metal with lower emissions than traditional blast furnaces.

What strategies can manufacturers employ to address these challenges?

Facing a sea of challenges, from volatile costs to regulatory pressures, a manufacturer can either be overwhelmed or become more agile. Simply reacting to problems is a recipe for failure. The key is to adopt proactive strategies that turn these challenges into sources of competitive advantage for ourselves and our clients.

To address common challenges, manufacturers can implement strategies like vertical integration for supply chain control, investing in Industry 4.0 technologies for operational efficiency and quality, developing robust talent pipelines through training programs, and embracing sustainability as a core business driver to enhance brand value.

These strategies are not just theoretical; they are the pillars of a resilient manufacturing operation. For instance, by investing in digital technologies, we can predict maintenance needs before a breakdown occurs, preventing costly downtime that could impact a customer's delivery schedule. By building a sustainable operation, we not only meet regulations but also appeal to global clients who prioritize green supply chains. In my role at MFY, I’ve championed these initiatives because I’ve seen them work. They transform our company from a simple producer of steel into a reliable, efficient, and forward-thinking partner. Let’s explore how these strategies create tangible value.

In the face of relentless market pressures, the most successful stainless steel manufacturers are not those who are simply bigger, but those who are smarter, more agile, and more forward-thinking. Survival and leadership in this industry depend on the deliberate implementation of strategic initiatives designed to mitigate risks and capitalize on opportunities. These strategies are interconnected, creating a virtuous cycle where improvements in one area, such as technology, can drive benefits in another, like sustainability. For any buyer evaluating a potential manufacturing partner, understanding their strategic approach to these core challenges is a powerful indicator of their long-term reliability and viability.

Vertical Integration and Supply Chain Optimization

One of the most powerful strategies to combat raw material volatility and ensure supply stability is vertical integration. This involves a manufacturer taking control of multiple stages of the supply chain. At MFY, our integrated model is a core strength. It spans from raw material trading and sourcing all the way through to cold-rolling, tube manufacturing, warehousing, and logistics. By controlling these key nodes, we reduce our reliance on third-party suppliers and gain greater visibility and control over costs and timelines. For example, our in-house raw material trading division allows us to make strategic bulk purchases of nickel and ferrochrome4 when market conditions are favorable, insulating our production costs from short-term price spikes.

Beyond integration, optimizing the supply chain through data analytics is critical. We use sophisticated software to manage inventory levels, forecast demand, and streamline logistics. This allows us to operate on a just-in-time basis where possible, reducing the capital tied up in inventory while ensuring we have enough stock to meet customer commitments. I recently reviewed a case with our logistics team where we helped a large construction contractor in Southeast Asia. Their project had a phased delivery schedule over 18 months. By integrating their schedule with our production planning and warehousing capabilities, we were able to guarantee delivery within a 3-day window for each phase, eliminating their need for costly on-site storage and reducing their project risk significantly.

This level of control and optimization provides immense value to our clients. It translates into more stable pricing, reliable lead times, and the flexibility to accommodate complex delivery requirements. In a world of fragile supply chains, a partner with a robust, integrated, and optimized system is a significant competitive asset.

Investment in Technology and Industry 4.0

Embracing the principles of Industry 4.0 is no longer optional; it's essential for efficiency and quality. This means creating "smart factories" where equipment, processes, and people are interconnected through data. We have been systematically investing in this transformation. For instance, our cold-rolling mills are equipped with a network of IoT (Internet of Things) sensors that constantly stream data on temperature, pressure, tension, and vibration. This data is fed into a central system that uses machine learning algorithms to predict when a component, like a roller bearing, is likely to fail. This predictive maintenance allows us to schedule repairs during planned downtime, preventing catastrophic failures that could halt production for days and delay customer orders.

This technology is also fundamental to achieving the stringent quality control our customers demand. In the past, quality checks were often done by sampling. Today, we use automated, in-line inspection systems that monitor 100% of the coil. High-speed cameras scan for surface defects, while laser-based systems measure thickness and width in real-time. If any parameter deviates from the specification, the system can automatically adjust the process or flag the section for review. According to a study by Boston Consulting Group, manufacturers adopting Industry 4.0 can see a 15-20% increase in production efficiency and a 10-12% reduction in quality-related costs.

For our customers, the benefit of this technological investment is twofold. First, it guarantees a higher and more consistent level of quality, reducing the risk of them receiving faulty material. Second, the operational efficiencies we gain help us maintain competitive pricing and reliable delivery schedules. When a client specifies a 2B finish with a precise Ra (surface roughness) value for a high-end appliance, they can be confident that our process control systems will deliver that exact specification on every coil.

Talent Development and Knowledge Management

Advanced technology is useless without skilled people to operate, maintain, and innovate with it. A critical, yet often overlooked, challenge in manufacturing is the growing shortage of skilled labor, from metallurgists and process engineers to specialized maintenance technicians. A key strategy to address this is a deep commitment to internal talent development and knowledge management. We cannot simply rely on the external market to provide the expertise we need.

At MFY, we have established comprehensive in-house training programs. New operators are paired with experienced mentors in a structured apprenticeship system. We also partner with local technical universities to create curricula that are relevant to modern steelmaking, offering internships and sponsoring research projects. This creates a sustainable pipeline of talent that understands our specific equipment and quality culture. A prime example is our team of AOD furnace operators. This is a highly specialized role requiring a deep understanding of thermodynamics and chemistry. Our internal certification program ensures that every operator has mastered the skills to produce clean, precise steel chemistry batch after batch.

Furthermore, we are building robust knowledge management systems to capture the decades of experience held by our veteran employees. This includes creating detailed digital work instructions, video tutorials for maintenance procedures, and a central database of solutions to common production problems. This ensures that valuable institutional knowledge is not lost when an employee retires. By investing in our people, we are investing in the long-term quality and reliability of our products. A well-trained, engaged workforce is our first line of defense against quality deviations and our primary driver of continuous improvement.

| Strategy | Objective | Ключевые действия | Benefit for Customer |

|---|---|---|---|

| Vertical Integration | Control costs and ensure supply stability | Acquire/build capabilities in raw materials, logistics, processing | More stable pricing, reliable lead times, greater flexibility |

| Industry 4.0 Investment | Boost efficiency and quality | Implement IoT, data analytics, predictive maintenance, automated inspection | Higher product consistency, fewer defects, reliable delivery |

| Talent Development | Overcome skilled labor shortage | Create in-house training, university partnerships, knowledge management | Assurance of expert oversight, leading to consistent quality |

| Embracing Sustainability | Meet regulations and enhance brand value | Invest in green tech, reduce energy/emissions, promote recycled content | Partnership with a responsible supplier, support for their ESG goals |

Vertical integration reduces supply chain risksПравда

Controlling multiple supply chain stages provides greater cost visibility and stability.

Industry 4.0 decreases production efficiencyЛожь

Smart factories using IoT and data analytics typically achieve 15-20% efficiency gains.

What are the technological advancements in stainless steel 304 coil manufacturing?

Are you sourcing from a manufacturer stuck in the past? In an industry as traditional as steel, it's easy to assume that production methods haven't changed. This assumption could mean you're missing out on the superior quality, consistency, and efficiency offered by modern, technologically advanced producers.

Technological advancements in stainless steel 304 coil manufacturing are centered on Industry 4.0 integration, including AI-driven process control for superior quality, advanced automation for efficiency, the development of specialized "green steel" production methods, and enhanced data analytics for supply chain transparency.

These are not futuristic concepts; they are practical innovations reshaping our factory floors today. I've personally witnessed how implementing an AI-powered system to control furnace temperatures has reduced energy consumption while simultaneously improving the metallurgical consistency of our steel. This means a better, more reliable product for our clients, produced more sustainably. For any buyer, partnering with a manufacturer at the forefront of this technological wave is a direct investment in the quality and resilience of your own business. Let's examine the innovations that are making the biggest impact.

The perception of steelmaking as a "heavy and old" industry is rapidly becoming outdated. Today, the modern stainless steel mill is a hub of high technology, where data science, automation, and advanced metallurgy converge to create products of unprecedented quality and precision. These advancements are not merely incremental; they are transformative, enabling manufacturers to overcome traditional challenges and deliver new levels of value to their customers. For a buyer, aligning with a technologically advanced manufacturer means gaining access to a superior product and a more efficient, transparent, and reliable supply chain.

AI-Driven Process Control and Quality Assurance

The most significant technological leap in recent years is the application of Artificial Intelligence (AI) and Machine Learning (ML) to control the manufacturing process. In a traditional mill, operators rely on experience and standard operating procedures to manage complex variables like furnace temperature, chemical additions, and rolling pressure. Today, AI-powered systems can analyze thousands of data points from sensors in real-time, making micro-adjustments far more quickly and precisely than any human operator could. For example, in the AOD converter5, an AI model can predict the final chemical composition based on the initial inputs and process parameters, recommending the exact amount of ferroalloys to add to hit the Grade 304 specification perfectly every time. This reduces the consumption of expensive alloys and minimizes batch-to-batch variation.

This technology extends to quality assurance. Traditional surface inspection, even with cameras, could be prone to errors. Modern AI-driven machine vision systems are a game-changer. These systems are trained on millions of images of both perfect and defective coil surfaces. They can not only detect a potential defect but also classify it (e.g., scratch, roll mark, inclusion) and even identify its likely root cause in the production line. A recent deployment in our cold-rolling line improved our defect detection rate by over 30% and reduced false positives, ensuring that only pristine coils are shipped to customers who require a flawless finish, like those in the high-end appliance or architectural sectors.

The impact of AI is profound. It moves manufacturing from a reactive to a predictive and prescriptive model. We are no longer just correcting problems after they occur; we are preventing them from happening in the first place. This results in higher yields, lower costs, and—most importantly for the customer—a product with unmatched consistency and reliability.

Advanced Automation and Robotics

Automation is transforming the physical workflow within the steel mill, improving safety, efficiency, and precision. While automation has been used for years in basic tasks, the new generation of robotics and autonomous systems is taking on far more complex roles. For example, autonomous guided vehicles (AGVs)6 are now used to transport heavy coils between the rolling mill, the annealing line, and the warehouse. This reduces the risk of accidents associated with overhead cranes and human-operated forklifts and optimizes material flow throughout the plant.

In the production line itself, robotics are being deployed for tasks that require high precision or are hazardous for human workers. Robotic arms are used for taking samples of molten steel, performing automated welding at the start and end of coils in continuous lines, and even for packaging and strapping finished coils. This not only enhances worker safety but also improves process consistency. A robot will perform a task in the exact same way every single time, eliminating the human variability that can sometimes lead to quality issues. A study by the International Federation of Robotics (IFR) shows that the metals industry is one of the fastest-growing adopters of industrial robots, driven by the need for higher productivity and quality.

For our clients, this increased automation translates directly into more reliable production schedules. Automated systems don't get tired and are less prone to error, leading to fewer unplanned stoppages. When we commit to a delivery date for a customer's just-in-time production line, our high level of automation gives us—and them—a much higher degree of confidence that we will meet that commitment without fail.

"Green Steel" Innovations and Sustainable Technologies

Technology is at the heart of the industry's response to the challenge of sustainability. The development of "green steel" is a top priority, and innovation is focused on two main areas: reducing the carbon footprint of the production process and creating more sustainable products. One of the most promising technological pathways is the use of green hydrogen to replace fossil fuels in the steelmaking process. While still in early stages for bulk production, pilot projects are demonstrating its feasibility. Another key technology is Улавливание, использование и хранение углерода (CCUS)7, which involves capturing CO2 emissions from the furnace off-gas and either storing them underground or converting them into useful products.

More immediate technological advancements are focused on energy efficiency and circular economy principles. As mentioned before, we invest in technologies like regenerative burners and waste heat recovery systems that capture exhaust heat and use it to pre-heat scrap metal or generate electricity. This can reduce the energy consumption of a furnace by up to 20%. A significant area of innovation at MFY is increasing the use of recycled content. We employ advanced scrap sorting and cleaning technologies to maximize the amount of post-consumer stainless steel scrap we can use in our EAFs. Using scrap instead of primary raw materials like nickel pig iron dramatically lowers the product's embedded carbon. We can now produce high-quality 304 coils with a certified recycled content of over 85%.

For our customers, particularly large multinational corporations with their own ambitious ESG (Environmental, Social, and Governance) targets, this is a critical value proposition. By sourcing from a manufacturer that has invested in these green technologies, they are not only buying a coil of steel; they are actively reducing the carbon footprint of their own supply chain (Scope 3 emissions). We provide them with detailed data on the embedded carbon and recycled content of our products, helping them meet their sustainability reporting requirements and enhance their brand reputation.

| Технология | Primary Application in Manufacturing | Key Benefit for Manufacturer | Tangible Value for Customer |

|---|---|---|---|

| AI & Machine Learning | Real-time process control, predictive quality | Reduced raw material usage, higher yields, fewer defects | Unmatched product consistency, reliability, guaranteed specs |

| Advanced Automation & Robotics | Material handling, hazardous tasks, packaging | Improved safety, higher efficiency, reduced labor dependency | More reliable delivery schedules, fewer production delays |

| Green Steel & Sustainable Tech | Decarbonization, energy efficiency, recycling | Reduced environmental impact, lower energy costs, ESG compliance | Lower supply chain carbon footprint, supports sustainability goals |

AI improves 304 coil qualityПравда

AI-driven systems analyze real-time data to optimize furnace temperatures and chemical compositions, resulting in more consistent 304 stainless steel coils.

Robots increase production errorsЛожь

Advanced robotics perform tasks with perfect repeatability, actually reducing human error and improving product consistency in coil manufacturing.

Заключение

Ultimately, navigating the world of stainless steel 304 coil manufacturers requires a strategic lens. From understanding market dynamics to appreciating technological advancements, an informed approach is key. Choosing a partner who masters these complexities ensures a resilient supply chain and superior product quality for your business's success.

-

Gain insights into the historical evolution and its impact on standards and pricing ↩

-

Explore China's strategic advantages in stainless steel production ↩

-

Explore economic impacts of metal price shifts on stainless steel production ↩

-

Learn their roles and how they affect steel properties and cost ↩

-

Discover the function and benefits of an AOD converter in steel manufacturing ↩

-

Understand how AGVs improve logistics and safety in manufacturing plants ↩

-

Explore the role of CCUS in reducing industrial carbon emissions ↩

У вас есть вопросы или нужна дополнительная информация?

Свяжитесь с нами, чтобы получить индивидуальную помощь и квалифицированный совет.